|

|||

|

|

|

|

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

The Highest Rated Online Mortgage Lenders: Navigating the Digital LandscapeIn today’s fast-paced digital world, the process of securing a mortgage has significantly evolved, with online mortgage lenders gaining prominence due to their convenience, efficiency, and often competitive rates. As potential homeowners navigate through myriad options, understanding the landscape of the highest rated online mortgage lenders becomes crucial. This exploration is not merely about identifying the top players but also about appreciating the benefits and use cases that these digital platforms offer. The advent of online mortgage lending has democratized access to home financing, making it more accessible to a broader audience. Gone are the days when one had to schedule in-person meetings, shuffle through piles of paperwork, and wait weeks for approvals. Today, with a few clicks, potential borrowers can explore their options, submit applications, and receive pre-approvals, all from the comfort of their homes. Top-Rated Lenders and Their Unique Offerings

Each of these lenders brings unique strengths to the table, catering to different needs and preferences. For instance, those prioritizing speed and convenience might gravitate towards Rocket Mortgage, while cost-conscious borrowers might find Better.com’s fee-free approach more appealing. Additionally, SoFi’s comprehensive financial support can be a draw for those looking to integrate their mortgage into a broader financial strategy. Furthermore, the user experience on these platforms is tailored to foster confidence and ease, with intuitive interfaces that guide users through each stage of the application process. Another significant benefit of online mortgage lenders is the transparency they offer. Many of these platforms provide detailed breakdowns of rates and fees upfront, allowing borrowers to compare offers effectively without hidden surprises. This level of transparency builds trust and empowers borrowers to make well-informed decisions. Moreover, online mortgage lenders often leverage technology to offer personalized solutions. By using algorithms that analyze a borrower’s financial profile, these platforms can suggest products that best fit individual needs, thereby optimizing the borrowing experience. In conclusion, the rise of highly rated online mortgage lenders marks a pivotal shift in the home financing sector, offering unparalleled convenience, transparency, and personalization. As digital platforms continue to innovate, borrowers can expect even more tailored solutions, further simplifying the path to homeownership. Whether you're a first-time buyer or looking to refinance, exploring these top-rated online lenders could be a wise step in achieving your real estate goals. https://money.com/best-mortgage-lenders/

Our top picks for best mortgage lenders include Rocket Mortgage (best customer service), LendingTree (best marketplace) and Veterans United ( ... https://www.debt.org/real-estate/mortgages/online/

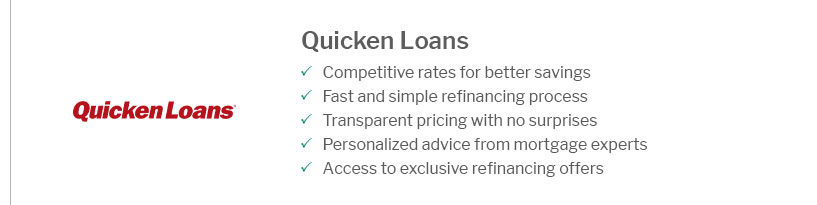

Quicken is the biggest online mortgage company, and has been ranked as the top lender for 10 years in a row in the JD Power 2019 US Primary Mortgage ... https://money.usnews.com/loans/mortgages/state/texas-mortgage-lenders

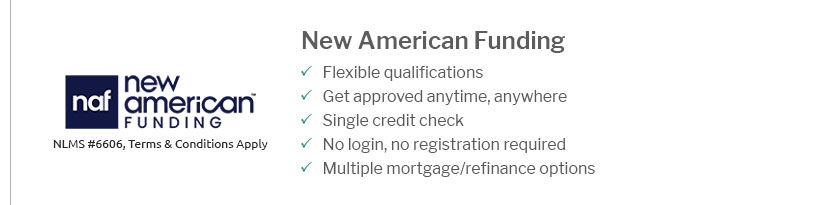

U.S. News' Best Texas Mortgage Lenders ; New American Funding. 4.7. NMLS #6606 ; Rocket Mortgage. 4.9. NMLS #3030 ; Farmers Bank of Kansas City. 4.7. NMLS #613839.

|

|---|